| OLD 25C TAX CREDIT | NEW 25C TAX CREDIT | |

| Timing | Retroactively extended through December 31, 2022 | January 1, 2023, through December 31, 2032 |

| Limits | $500 lifetime limit for all qualified products | No lifetime limits $1,200 annual limit for all qualified products |

| Eligible Amounts | 10% of product cost Windows: $200 lifetime limit for ENERGY STAR Version 6.0 Doors: $500 lifetime limit for ENERGY STAR Version 6.0 | 30% of product cost Windows: $600 annual limit for ENERGY STAR Most Efficient Doors: $500 annual limit ($250 per exterior door) for applicable ENERGY STAR requirements |

*See Important Terms & Conditions Below

25C TAX CREDIT CHANGES

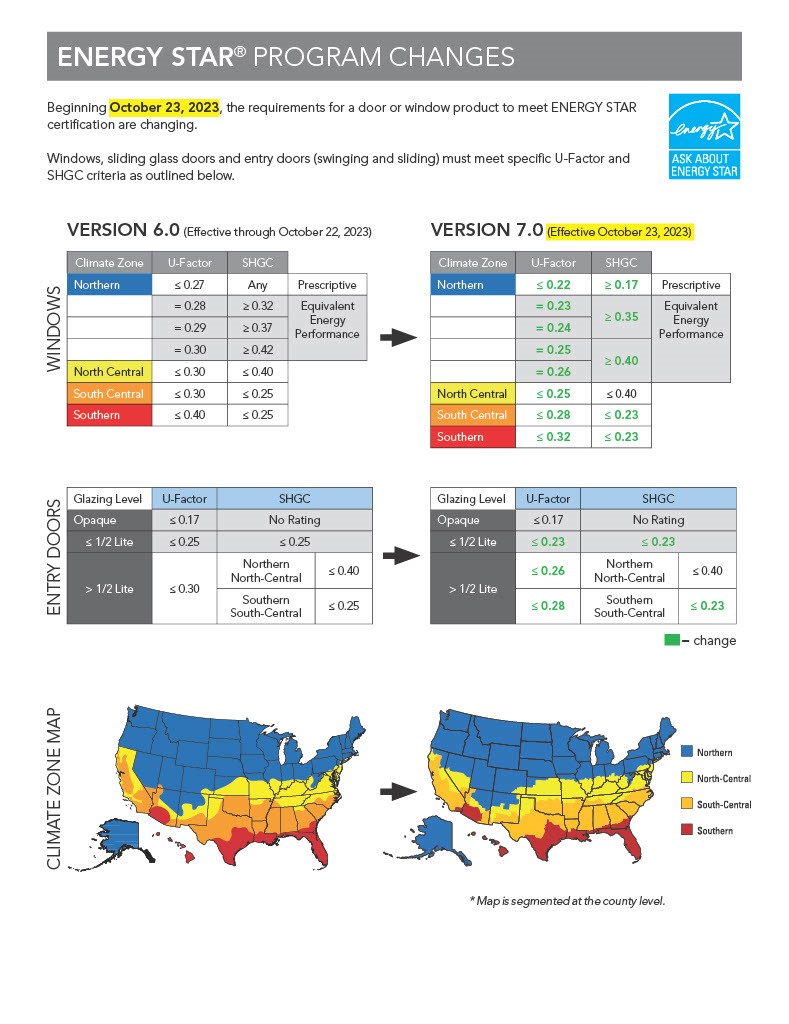

To qualify for a tax credit, a door or window product must meet ENERGY STAR® certification by the manufacturer, following guidelines from the Environmental Protection Agency (EPA).

The credit is allowed for qualifying property placed in service on or after January 1,2023, and through December 31, 2032.

**Home energy audits

**Qualified energy efficiency improvements

**Residential energy property expenditures